ASIC Miner Profitability: Fact or Fiction?

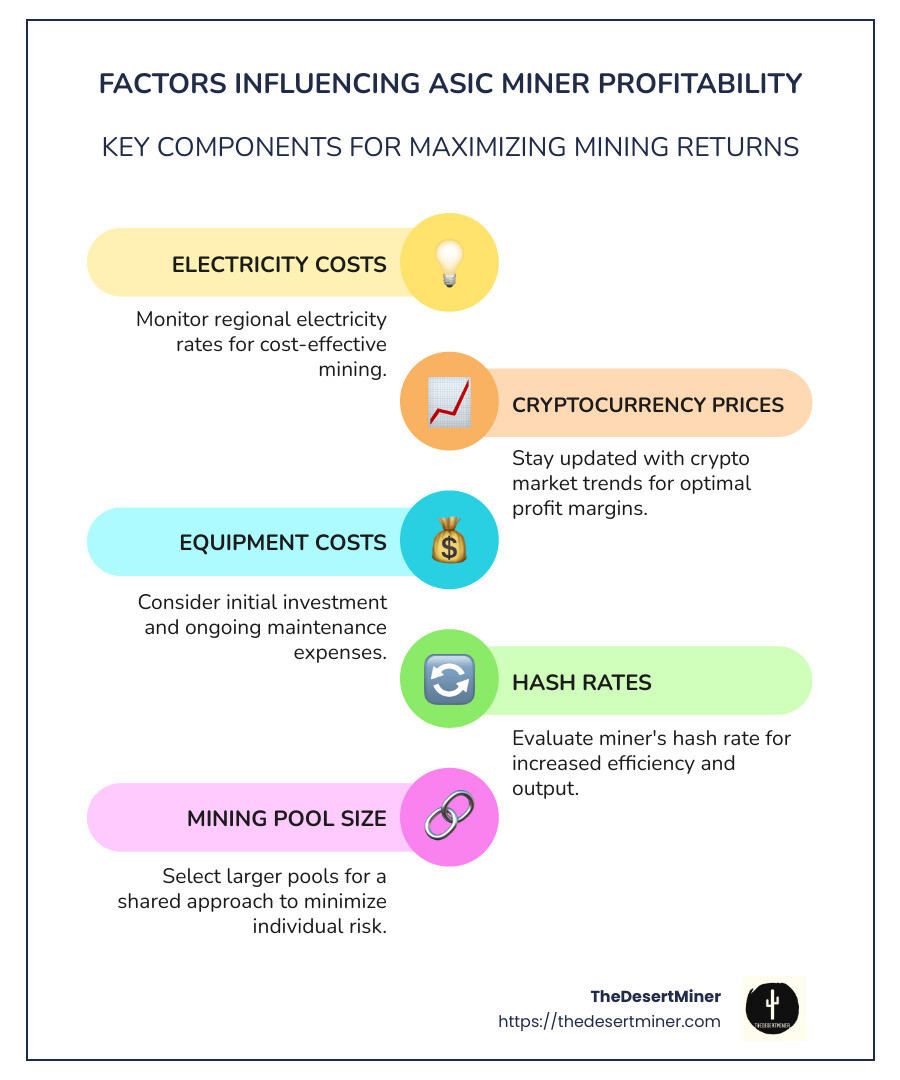

In the dynamic world of cryptocurrency, understanding asic miner profitability is essential for both experienced miners and newcomers. ASIC miners are a cornerstone of Bitcoin mining, but several factors influence their profitability:

- Profit Margins: These fluctuate based on electricity costs and Bitcoin’s market value.

- Mining Pools: They provide a shared approach to rewards, impacting revenue.

- Equipment Costs: Initial and maintenance expenses are crucial for ROI.

For immediate insights, consider power consumption, hash rates, and current crypto prices to estimate potential profits.

As The Desert Miner, I embarked on my mining journey in early 2021, combining technical expertise with problem-solving skills. My experience demonstrates how understanding asic miner profitability can enhance your ventures, offering both hobbyists and entrepreneurs a roadmap to success.

For more information on ASIC miners, including the Bitmain Antminer KA3, visit Bitmain’s official site.

Understanding ASIC Miner Profitability

When diving into ASIC mining, understanding the factors that influence profitability is essential. Let’s break down these elements to see how they impact your bottom line.

Factors Influencing Profitability

Hash Rates, Power Consumption, and Energy Efficiency

Hash rates measure how quickly a miner can solve complex mathematical puzzles, vital for earning rewards. A higher hash rate often means more potential earnings. However, this comes with increased power consumption.

For instance, the ElphaPex DG1 offers a hash rate of 11.00 Gh/s with power consumption at 3420W. Compare this to the Bitmain Antminer L7, which achieves 9.50 Gh/s at 3425W. While the ElphaPex DG1 has a higher hash rate, its power efficiency is slightly lower than the Antminer L7.

Energy efficiency is crucial. It determines how much electricity is used to generate each unit of cryptocurrency. More efficient miners convert energy into coins with less waste. This efficiency is often expressed in W/Gh or W/Th. Lower values mean better efficiency.

Electricity Costs and Cryptocurrency Prices

Electricity prices can make or break your mining operation. For example, a miner paying $0.10 per kWh will have a different profitability compared to someone paying $0.05 per kWh. The Goldshell AL-MAX, with its 8.30 Th/s at 3350W, could be more profitable in a region with lower electricity costs.

Cryptocurrency prices also play a massive role. The higher the price of Bitcoin or other mined cryptocurrencies, the higher the potential revenue. However, prices are volatile, so staying updated with market trends is essential.

Most Profitable ASIC Miners

Here are some of the top contenders in the ASIC mining world:

-

ElphaPex DG1: Known for its balance of hash rate and power consumption, making it a solid choice for those looking to maximize efficiency without sacrificing performance.

-

Bitmain Antminer L7: Offers excellent efficiency and is a favorite among miners for its dependable performance and lower power consumption relative to its hash rate.

-

Goldshell AL-MAX: This miner is favored for its energy efficiency, making it ideal for regions with higher electricity prices. Its impressive hash rate makes it competitive in the mining landscape.

In conclusion, understanding these factors—hash rates, power consumption, energy efficiency, electricity costs, and cryptocurrency prices—can help you choose the right ASIC miner. Whether you opt for the ElphaPex DG1, Bitmain Antminer L7, or Goldshell AL-MAX, aligning these factors with your specific situation will guide you toward profitability.

ASIC Miner Profitability in 2025

The landscape of ASIC miner profitability is constantly evolving. As we look towards 2025, several key elements will shape the profitability of ASIC miners.

Real-time Profitability CalculationsOne of the most significant advancements in mining technology is the ability to calculate profitability in real-time. This is crucial because mining revenue can fluctuate based on various factors like cryptocurrency prices and network difficulty. Tools like mining profit calculators offer live income estimates, helping miners make informed decisions.

These calculators consider over 200+ coins and 25+ algorithms, providing a comprehensive overview of potential earnings. By entering your hardware specifications and electricity costs, you can see which miners are currently the most profitable. This feature is particularly useful for those using miners like the Bitmain Antminer KA3, which is designed to maximize efficiency and profitability.

Bitmain Antminer KA3

The Bitmain Antminer KA3 is a standout in the ASIC mining world. Known for its use of the SHA-256 algorithm, it’s custom for high efficiency and profitability. This miner ranks highly due to its impressive hash rate and power consumption balance. The KA3 is engineered to handle the increasing difficulty of mining algorithms, ensuring it remains competitive in 2025.

Mining Revenue and Profitability Duration

Mining revenue is influenced by the efficiency of your hardware. The KA3’s design focuses on delivering maximum output with minimum energy input, an essential factor as electricity costs rise. Its profitability duration—how long it remains profitable before needing an upgrade—is extended due to its advanced technology and adaptability to difficulty changes.

Efficiency and Profitability Ranking

Efficiency is a crucial metric for miners. The KA3 excels in this area, offering a high hash rate with lower power consumption. This efficiency places it near the top of profitability rankings, making it a preferred choice for miners aiming for long-term gains. Its robust design and cutting-edge features ensure that it can adapt to market and technological changes, maintaining its profitability over time.

In summary, as we move into 2025, the ability to calculate real-time profitability and choose efficient miners like the Bitmain Antminer KA3 will be key to success in the ever-changing world of cryptocurrency mining.